our services

our services

Mine Planning and Design

Strategic Mine Scheduling

Cost & Financial Modelling

Corporate Consulting

Strategy Management

Independent Expert

Mine Planning, Design and Optimisation

IMC uses a range of in-house and off the rack software solutions to assist with mine planning and development of optimised strategic development plans.

IMC has experience planning and optimising mines in Australia and overseas. IMC’s team has worked in a range of commodities and operation types from open cut coal mining to underground diamond mines. IMC uses a range of CAD programs to plan and design mines combined with optimisation software to deliver optimised mine designs.

As consultants, IMC can assist with the adoption of modern mine planning techniques at the strategic or tactical mine planning level to ensure mines are developed to maximise NPV within the bounds of practical mining.

Our specialisations include:

Multi Mine Planning

IMC can plan, design and optimise a resource requiring multiple mines in different locations. IMC has the ability to schedule multiple mines together to determine which assets can provide the highest value.

Block Model Interpretation and Manipulation

Block model interpretation and manipulation is a core element of sound mine design and optimisation. IMC can read and manipulate block models using bespoke data science programming.

Block Model Re-blocking

Block model re-blocking is the process of modifying the dimensions of the blocks to accurately represent operational practicalities of mining i.e. mining selectivity and bench height studies. For example, a block model with large blocks may be re-blocked into smaller units to improve resolution at ore/waste boundaries, useful when modelling dilution. Using IMC’s in-house data science programs, any block model can be re-blocked, regularised and prepared for optimisation.

Open Pit Mine Design

IMC specialises in designing optimal open pits. Using a combination of the Pseudoflow algorithm and CAD, IMC can generate optimal shells for a deposit. IMC have designed and optimised pits for a range of commodities and organisations ranging from bauxite to diamonds.

Skin Analysis

Skin Analysis takes the undiscounted pit shells defined by Pseudoflow or the Lersch-Grossman algorithm and evaluates incremental NPV of a combination of pushbacks to determine the highest value mining sequence.

Pit shells defined by the Pseudoflow algorithm are only optimal in terms of undiscounted cashflow. For example a final pit stage may contain a substantial amount of pre-strip waste that must be mined before ore is encountered at depth, it is possible that the largest pit shell leads to a negative incremental discounted value compared to a final shell at a lower revenue factor.

Discounted Incremental Value Analysis

Similar to a Skin Anlaysis, Discounted Incremental Value Analysis (DIVA) is a bespoke method of optimising a series of pit shells to maximise NPV. Developed by IMC for complex deposits, pit shells of multiple deposits are compared to other shells simultaneously using Mixed Integer Linear Programming (MILP) to select the shells that maximise NPV.

This is useful for when multiple deposits feed to single process with a combined constraint. DIVA quickly determines the highest value shell combination with respect to variable costs, fixed costs, processing constraints, stockpile reclaiming and primary equipment requirements.

Strategic Mine Scheduling

Using Mixed Integer Linear Programming (MILP), IMC can complete integrated strategic mine production schedules that maximise value.

Using advanced algorithms like CPLEX, IMC can schedule a mine considering its downstream processes and market constraints simultaneously to maximise value.

IMC has experience scheduling a wide range of commodities and mine types. Fundamentally, good strategic mine scheduling is key to aligning mine plan to corporate objectives. IMC are passionate about ensuring that our mine schedules are practical.

Financial & Cost modelling

IMC Mining provides specialised services to develop financial models for projects, businesses or proposed transactions.

IMC Mining provides specialised services to develop financial models for projects, businesses or proposed transactions. We have experience in how to go from a blank workbook to a bankable cash flow model suitable for investment scenario evaluation. We develop complete financial models for all stages of project development including scoping, pre-feasibility and feasibility study and optimisation.

Our cost modelling pragmatically presents the pros and cons of solutions offered and enumerates the risk/reward of alternate outcomes from the planning process. This provides mining executives at all levels within the organisation with a comprehensive matrix of outcomes to assist with decision making. Once finalised decisions have been made, our team then provide an execution plan to achieve the desired outcomes.

Corporate Consulting

Audit, Ore reserve Estimation and Due Diligence Review

Audit and Review

IMC can provide assistance and advice for a decision that requires a review of mineral projects for acquisitions, mergers and finance. Our reviews and audits improve the level of assurance in the reliability of estimated short-term (grade control) estimates, reconciliation, Mineral Resources and Ore Reserves. IMC can audit and evaluate exploration results, geological modelling, resource estimation, procedures and JORC compliance.

Ore Reserve Estimation – JORC, NI 43-101, SAMREC and SEC

IMC can produce ore reserve reports for the world’s major reporting codes: JORC, NI 43-101, SAMREC and SEC/Sarbanes Oxley. With our experience, knowledge, understanding and exposure, we are able to compile most ore reserve reports and complete the required CP and Qualified Persons sign-off statements.

Due Diligence Review

IMC Mining provides a range of due diligence services for both the seller and acquirer. Our range of due diligence reviews can be from a high level to a full in-depth review. IMC can review all technical aspects (resources, reserves, mining, processing, logistics and administration), as well as including full environmental, legal and financial due diligence.

IMC Mining has written a number of independent technical reports over a variety of commodities and project locations for listing, valuation or M&A purposes. Our principals are able to provide clear, compliant, concise and well-written documents which offer value.

Strategy Management

IMC can draw on our own knowledge and abilities as well as being able to bring together teams from other sources to effectively solve problems. We can pull together the best team for the job as well as manage these bodies.

Independent Expert Report and Mediation Support

IMC Mining Consultants have worked with many law firms and barristers within the Australian legal system (Victoria, New South Wales, Queensland and Western Australia) and also as an expert at the Singapore International Mediation Centre.

The mining independent expert reports we have completed have encompassed:

- Management of teams of experts for complex disputes addressing consequential impacts throughout the mine production system. This is including the mine planning/scheduling/operating costs implications, the processing implications and how these may have been impacted by a claimed under performing item – including the up stream and down stream consequences of such a failure, the control systems, electrical systems or manufacturing issues.

- Cost modelling and financial analysis under systems such as the Valmin code to assess fair pricing for issues related to taxation and shareholder transfers.

- Mine contractor related disputes.

Stewart Lewis has had experience in all the above independent expert matters. This experience enables Stewart to assist with the development of sensible and fair Independent Expert Reports that meet the requirements of solicitors and barristers and the courts. Stewart is able to focus on the key issues that require expert opinion without resorting to unnecessary jargon. This pragmatic approach has assisted with pre-trial settlement negotiations and has provided litigation teams with a sensible framework for the technical aspects of various disputes to assist with the legal process. The independent expert reports have been related to disputes of less than $10M to many hundreds of millions of dollars.

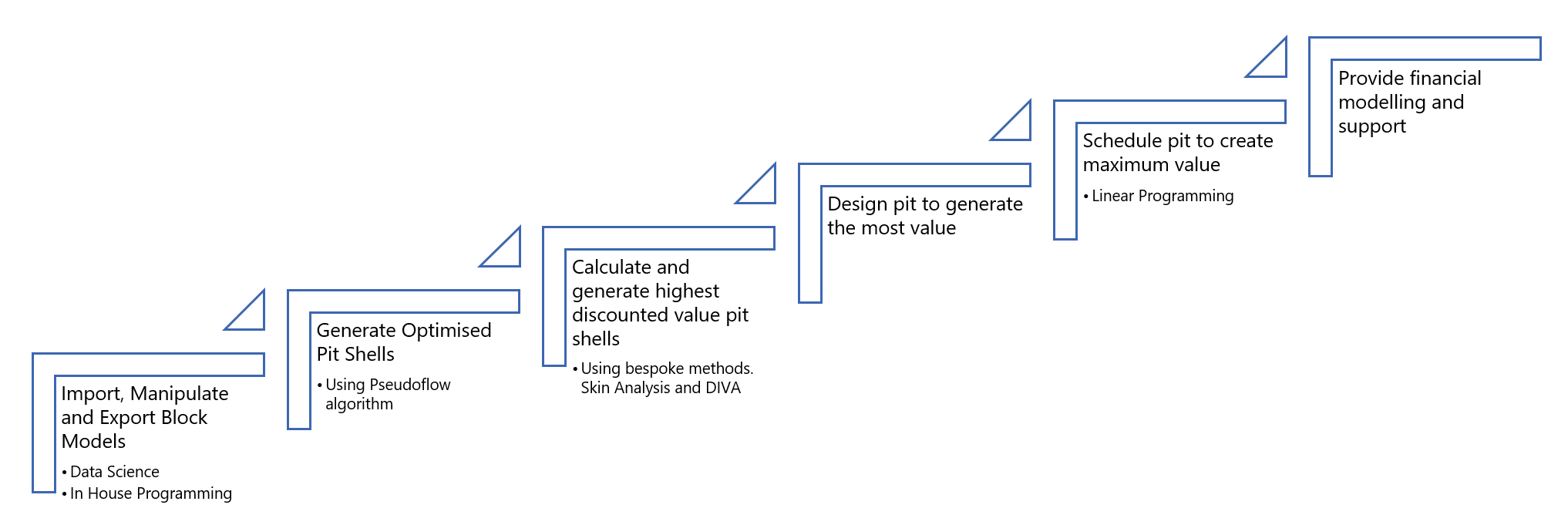

IMC's Unique Process

IMC have a unique mining optimisation process. At IMC we can take block models, generate optimised pit shells, calculate the highest discounted value pit shell and schedule this optimised design. This process can culminate in a zero based cost model to influence decisions. IMC can help with any stage of this process and progress your project.